Wind is invisible until it causes severe damage to your property. Common wind insurance claims include roofs blowing off, trees falling on property, fences being blown down and leaky windows. Sometimes, the damage is hidden and isn’t always caught upon the initial assessment of your property. This is where we come in.

In order to get the best settlement from your insurance, we will determine the coverage in your policy, inspect the damage, record evidence, evaluate any losses, and then present evidence and negotiate a settlement.

OUR MISSION IS TO MAKE SURE POLICYHOLDERS RECEIVE ALL THE BENEFITS THEY ARE ENTITLED TO AFTER A PROPERTY DAMAGE LOSS AND TO — USE OUR EXPERTISE TO REDUCE STRESS, SPEED UP THE CLAIM TIMELINE AND PREVENT COSTLY MISTAKES.

Signs You Need A Public Adjuster

- You are overwhelmed by the insurance claim process

- Your insurance company is not moving quickly to get you money for recovery.

- Your business suffered damage that has resulted in loss of income.

- You need an advocate on your side to get you a fair and equitable settlement.

- The insurance company denied your claim.

- The insurance company unfairly underpaid your claim.

Our Approach

Our #1 goal is to act and represent policyholder’s best interest in the claim process so they can focus on getting their life back to normal. In order to accomplish that, our approach to each claim is different than most public adjusting companies.

Missed or undocumented damage often leads to a lesser claim payout. We go the extra mile to ensure proper claim documentation is done. This also means less surprises later and a faster claim payout.

Every insurance policy is different. We will analyze and review your policy to make sure all benefits are recovered. If you’ve already filed a claim and feel like you are getting paid less than what you are owed OR your claim has been denied, we will review it for free.

We understand just how policies are upheld and will use our knowledge to fight on your behalf. Few, if any, other public adjusters have the knowledge and experience in roofing like we do.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

It Doesn't Cost To Use Us, It Pays

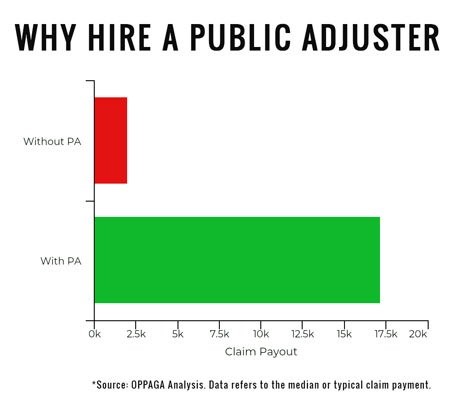

According to one study, using a public adjuster to help with your property damage insurance claim can increase by 757%.

With your home or business on the line, you’ll need all the expertise you can get. Our public adjusting team is committed to getting what you are owed. Throughout our entire process, our negotiations are fair, reasonable, and always focused on your benefit.